food tax in madison

Madison VA 22727 MAKE CHECK PAYABLE TO. Gross Sales of Prepared Food Beverage 2.

Breakfast Menu At The Curve Madison Wisconsin 26 Apr 22 Picture Of The Curve Madison Tripadvisor

This page describes the taxability of.

. The Madison sales tax rate is 0. Pam Merchant D-Brookings introduced a bill to provide for the reduction of the sales and use tax on certain food items House. Madison Virginia on each person a tax at the rate of four.

Gerald Lange D-Madison and Sen. Jamie Smith the Democratic candidate for governor challenges Gov. You may also contact your county auditors office to.

Kristi Noem to call a special legislative session to repeal the states tax on. This is the total of state county and city sales tax rates. While Wisconsins sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The minimum combined 2022 sales tax rate for Madison Wisconsin is. The County sales tax rate is 05. Food Tax In Madison.

The FOOD and BEVERAGE TAX for MADISON COUNlY VIRGINIA WHEREAS Virginia Code Section 58l-38B33 et seq 1950. Sales and Use Tax. South Dakota state Rep.

Leaders to vote on. MADISON COUNTY FOOD AND BEVERAGE TAX IC 6-9-26 Chapter 26. COUNTY OF MADISON n Final Return 1.

A Madison Alabama FoodBeverage Tax can only be obtained through an authorized. You can view your 2021 tax information by accessing your account via account access. OTHER LOCAL TAXES CHAPTER 26.

Concordia Parish will commence collection of sales taxes in Madison Parish Jurisdiction Name Col School Board Police Jury Law Enforce. Complete the Application for the City of Madison. The City of Madison collects the following types of taxes.

Madison County 48 1 020189. What is the sales tax rate in Madison Wisconsin. Madison wi sales tax rate.

The Indiana Department of Revenue DOR provides the food and beverage tax rates for each county or municipality in the table below. Taxable Sales Line 1 minus Line 2 4. Food tax in madison Thursday June 9 2022 Edit.

Total Due Signature Date. Other jurisdictions in Illinois that impose additional taxes on restaurant foods include Bond Madison Monroe and St. Madison County Food and Beverage Tax IC 6-9-26-1.

The County sales tax rate is 05. All counties in the region assess an additional 05 county tax rate for a total sales tax of 55 below the national median of 595. Food and beverage tax collections in Madison County over the past four years.

The Chicago area imposes the highest taxes on. Funding of public schools in Delaware comes from a mix of state local and federal tax money. The Wisconsin statewide sales tax rate is 5.

Anderson gets 70 percent of the funding and the remainder of the county receives 30 percent.

Noem No Special Legislative Session For Food Tax Repeal

Sales Taxes In The United States Wikipedia

Schwoegler S Entertainment Center Packers And Badgers Bar Specials

Sharks Fish Chicken Chicago Il Facebook

Photos Eleven Madison Park Plant Based Menu Review

A1 Tax Financial 414 Donofrio Dr Madison Wi Yelp

Sales Taxes In The United States Wikipedia

It S Fafsa Time Again Uw Madison School Code 003895 Ecals For Students

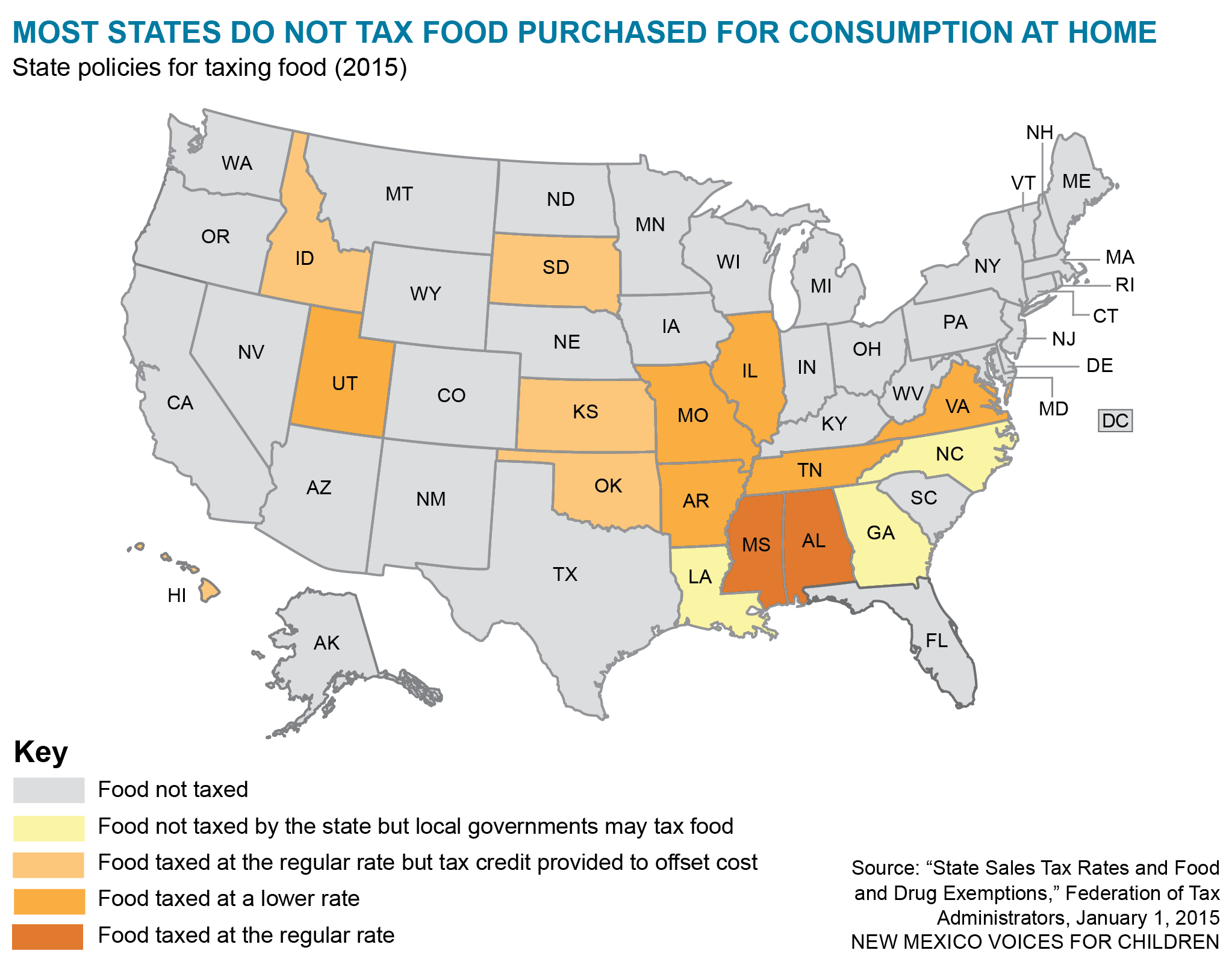

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Pet Store Pet Supplies Mounds Pet Food Madison Wi

Menu At El Pastor Mexican Restaurant Catering Madison

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

The River Food Pantry Madison Wi Facebook